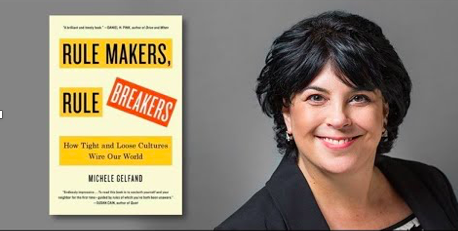

In the book “Rule Makers, Rule Breakers,” cultural psychologist Michele Gelfand explores cultural norms within the two primary categories of “tight” and “loose.” Gelfand proposes that compelling benefits can be found within both structures whether they are applied to governments, companies or families. Let’s take a quick look at the key differences:

- Social norms are unspoken rules that dictate acceptable behavior, providing predictability which is essential to cooperation.

- Social norms are helpful to leaders in building cooperative group dynamics and solving or diffusing conflict flare-ups.

- Stricter or “tight” social norms found in countries, regions, or companies have a highly codified system in etiquette and more stringent rules accompanied by more severe punishments for rule-breakers. Tight cultures are generally a response to areas that face multiple threats like natural disasters, disease, scare resources or invaders.

- Tight cultures promote orderly and predictable lifestyles and enjoy lower crime rates with cleaner and quieter cities.

- Relaxed or “looser” social norms are more open-minded and individualistic with less real or perceived threats.

- Loose cultures have wider public participation in activities and governance and also attract more creative and innovation types.

Gelfand emphasizes that neither one does a better job of promoting the general welfare. The key to the most productive state is achieving a flexible balance between laxity and restriction. “Just as countries have practical reasons for becoming collectively higher or looser, so do industries,” says Gelfand.

Companies that are able to develop a “tight-loose ambidexterity” of evolving approaches as the situation requires will have the best chance at succeeding in the short- and long-term. This ambidexterity can help with situations from crisis management to successful mergers. “By understanding the hidden force of social norms in their organizations, business leaders can effectively shepherd their companies toward greater tight-loose balance,” Gelfand writes.